Having an emergency or just need some quick cash without any delays or problems? Then you might consider getting one of the quick loans with no credit check options.

If you will get the loan of R300 with the term of 5 days, your totally payment would be R364.25. The fee is R64.25

If you will get the loan of R500 with the term of 1 month, your totally payment would be R674. The fee is R174.

If you will get the loan of R1.000 with the term of 12 months, your totally payment would be R2.160. The fee is R1.160.

If you will get the loan of R100 with the term of 7 days, your totally payment would be R189.36. The fee is R89.36.

If you will get the loan of R1.000 with the term of 6 months, your totally payment would be R1.765.5. The fee is R765.5.

If you will get the loan of R10.000 with the term of 12 months, your totally payment would be R12.672. The fee is R2.672.

If you will get the loan of R2.000 with the term of 6 months, your totally payment would be R2.957.32. The fee is R957.32.

For the purpose of providing an example of the rates and terms, if you borrow R15,000 over 15 months at a fixed rate of 28% per annum, with an admin fee of R68.40 per month as well as an initiation fee of R1,197 the charges would amount to a representative rate of 68% APR (fixed). The total amount repayable would be R22,717.

No. No loan is guaranteed. They need to make sure that you can repay the loan and all your other existing expenses.

Yes, you can. And, you will not pay any penalties for it. In fact, you will save money in some interest.

In emergencies, many people are applying for a quick loan with no credit checks. But, if you don’t know what it really means and doesn’t understand how the loan works, then it will be quite hard to get your loan approved. With this guide, you are getting to know more about the no credit check loans and also find which of the South African quick loan services you can trust.

It depends on the type of quick loan service you are using, but normally within 24 to 48 hours.

There are many different no credit check loan options that you can choose from, but some of them aren’t as reliable as what you might think. This is why you need to know the best no credit check loan services that you can choose, and other essential information before you decide to go for this type of quick loan. These are everything you need to know about using the best quick loan service that offers a no credit check option.

What does it mean to apply for a quick loan no credit check service? Most people think that this means that you will be able to apply for a quick loan, where there isn’t any check on your bank account. This isn’t the truth. There are a couple of things that they still check before you are getting approved for your no credit check loan.

Even, if they won’t ask the credit bureau for your credit statements, they are still making sure that you can afford the loan. They are asking for bank statements, and you will need to provide proof of salary before any loan will be approved. You will also need to provide a list of all your expenses.

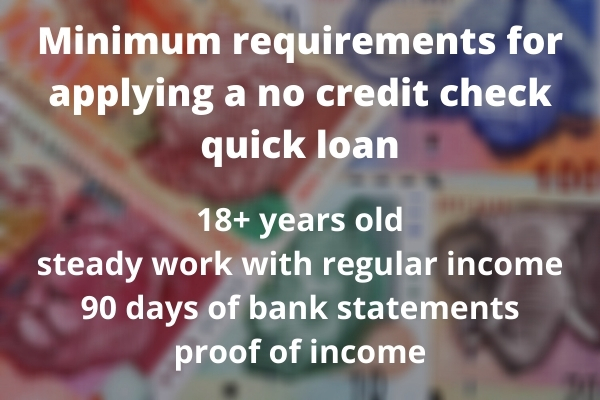

A mistake that many are making, is to think that with a quick loan no credit check application, there isn’t any way that you can be declined. But, it is far from the truth. There are also a couple of requirements that you need to consider before you can even apply for a no credit check quick loan.

You need to be over the age of 18 and need to have steady work with a regular income. Your expenses should not be more than 50% of your total income. And, you need to have 90 days of bank statements and proof of income. If you don’t have any one of these, you should not even consider applying. This is because these are the minimum requirements for applying for this type of quick loan.

One thing that you always need to remember when it comes to quick loan no credit check options is the fact that there are legitimate loan services and scams or loan sharks. And, it is important to make sure that you know the risks and how to avoid the risks in order for you to get assistance from the best and recommended loan services. This is how you can avoid risks of using quick loan no credit check services that are risky or going to get you into trouble:

To make sure that you are only using the best quick loans no credit check services, you need to know the top three services. With these three, you will not make a mistake, and if you qualify you will get the best possible service:

With Wonga, you can lend a minimum amount of R500 and a maximum of R5,000. The lending period goes from 4 days to 3 months for new clients and up to six months for existing and approved clients. The turnaround time is as soon as possible after the application and documents are submitted. Normally the documents needed are ID, bank statements, proof of residence, and Proof of income.

When you are applying at FASTA, you can lend any amount between R500 and R8,000. You will need to repay the loan between 1 or 3 months. It depends on the amount that you are lending. The normal turnaround time is about 5 minutes after submitting all the documents with the application. Making this a great option for someone that requires cash immediately. The documents that you need to submit is your ID, banking details, proof of income, and most recent proof of residence. Not one of the documents should be older than three months.

With MPOWA finance loans, the minimum lending amount is a bit higher at R1,000. The maximum that you can lend with them is R4,000. The time that you can repay the loan is ranging between 4 days and 3 months for new clients and up to 6 months for existing clients. The turnaround time is as soon as possible. Depending on the number of applications they have and if you have submitted the right documents. You need to submit your ID, banking details with bank statements, and proof of income.