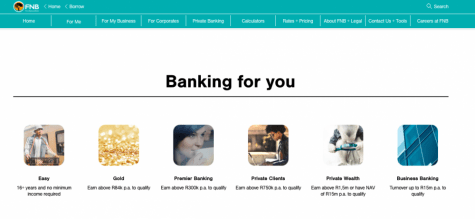

What FNB has to offer

FNB can be found in every city and town in South Africa. You can apply for a loan online, but it might not be recommended, because this is an official bank. Their head office is situated in Johannesburg. To getting any information about their loan services, you can contact them on any platform

What has FNB to offer? They offer short to medium-term loans to their clients. Loans where you can repay the loans from 1 to 60 months. Making it easier for you to choose the repayment plan that suits your needs and requirements best.

They offer loans up to R300 000 for those that qualify. The one thing that you need to know is that FNB’s interest isn’t that high and can start at 13%. There is also an additional fee that you need to pay that they are calling handling fees. Great for those that have a bad credit score or that is looking for immediate cash. Approval and payout are normally done within 24 hours if there aren’t any delays with the application.

Loan requirements

FNB is an NCR registered loan service. Therefore, their requirements are in line with the NCR guidelines. These are the requirements for getting an approved loan from FNB bank. They might be strict, but they make sure that you can afford the loan.

- Need to be older than 18 years till 64 years and have a valid South African ID.

- Be permanently employed with a salary of more than R5 000 and needs to prove it.

- Needs to agree to a credit check

- Needs to have a South African bank account

Is FNB a scam?

No. First National Bank is trustworthy loan provider. Their loans are prefectly legal and fine. You don't need to worry about hidden fees, terms, etc

FNB loan review conclusion

Most people don’t like applying for a loan at a bank. This is mostly because the process is longer and more frustrating. You need to visit the bank and apply directly. However, when you read reviews about FNB, you will see that this bank isn’t the same. Clients recommend FNB as a lender and say that they don’t decline applications as much as with other financial institutions.

Clients say that no matter if you are applying online, or if you are visiting a store, their service is professional and making sure that you are having the best chance of getting an approved loan. They will not give you a loan if you can’t afford the repayment but tries to assist you. A service that is normally hard to find from other banks.

FNB, a South African bank is an option to consider when you are looking for a loan. Offering loans up to R300 000 and repayment options up to 60 months. Interest rates aren’t as high as other institutions and start at only 13%. Sometimes it is best to make use of an official bank for getting a personal loan, then trying to get approved by another type of lender.