What Bayport has to offer

Bayport’s head office is situated in Sandton, but they have branches around RSA. You can use their locator to find the nearest. This is where all the loans are processed and payouts are made from. However, this isn’t an office where you can walk in to get assistance. You can get the necessary assistance from their platforms and contact details.

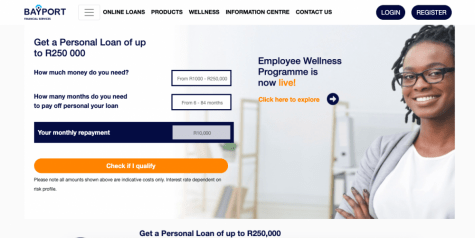

What does Bayport have to offer? What type of loan can you get from them? The one thing that you need to know is that you can get a loan up to R250 000 from them. The minimum amount that you can lend is R1 000. The repayment period varies from 6 to 84 months. This is one of the lenders that are offering the longest repayment option. Their interest rates are a bit high, starting at 20%.

The processing time for getting approval for a loan is normally just 15 minutes after you have submitted the documents. Payout following soon after the approval of the loan. A great thing about Bayport is that there are options for people to apply for a loan that has a bad credit score. However, then the interest rate is just going to be higher.

Loan requirements

It is important to know what the requirements and criteria are for you to apply for a loan at Bayport. Because they are registered with the NCR, their criteria are strict. These are the loan requirements for you to apply for a loan and to be considered.

- You must be older than 18 years of age

- You need to have a valid barcoded South African ID

- Must be permanent employed with a monthly salary of more than R 5 000

- Need to be able to prove that you can afford the repayment of the loan

- Credit checks will be done

- Need to give proof of residence and three month’s bank statements

Bayport review conclusion

Bayport has some positive and negative reviews. However, there aren’t any serious negative reviews that you need to know about. This is mostly people that are angry because their application was declined.

Most people that reviewed Bayport said that this is a trustworthy and legitimate service that is ensuring that any type of loan will be approved in no time. And, that you will be able to get the money in your account the same day. Making sure that you can use the money for the purpose you have lent it. Bayport is one of the most trustworthy and popular lenders in South Africa.

They are registered with NCR and make sure that everyone is considered for getting a chance on a loan. With a repayment plan for up to 84 months, everyone will be able to afford the loan’s repayment. And, with the amount you can lend from them, there is no reason why you can’t apply today.