Information about Capfin

There is a couple of information that you need to know before you can apply for a loan at Capfin. Things that you need to consider so that you choose the right lender and loan option. These are everything you need to know about Capfin loan.

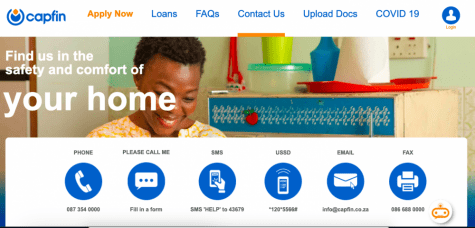

Capfin is registered with the NCR. With Capfin, you can apply directly online, phoning them or you can visit one of the branches that are offering walk-in services. Many stores are offering Capfin loans, like PEP where you can apply for a loan in-store. The Head office is situated in Cape Town. You can contact them via email, phone, or from their website. These are the contact details where you can contact them or get more information about their loans of:

What Capfin has to offer

They offer short to medium-term loans. Loans where you can repay the loans from 6 to 24 months. Making it easier for you to choose the repayment plan that suits your needs and requirements best.

They offer loans up to R50 000 for those that qualify. The one thing that you need to know is that interest is extremely high and can reach up to 79%. There is also an additional fee that you need to pay that they are calling handling fees. Great for those that have a bad credit score or that is looking for immediate cash. Approval and payout are normally done within 15 minutes to an hour.

Loan requirements

It is important to know what the requirements and criteria are for you to apply for a loan at Capfin. Because they are registered with the NCR, their criteria are strict. These are the loan requirements in order for you to apply for a loan and to be considered.

- You must be older than 18 years of age

- You need to have a valid barcoded South African ID

- Must be permanent employed with a monthly salary of more than R 5 000

- Need to be able to prove that you can afford the repayment of the loan

- Credit checks will be done Need to give proof of residence and three month’s bank statements

Is Capfin a scam?

No. Capfin is trustworthy loan provider. Their loans are prefectly legal and fine. You don't need to worry about hidden fees, terms, etc.

Capfin review conclusion

There are many positive reviews from clients and previous clients that have used Capfin before. They claim that payouts are done fast, without any problems, and that staff is friendly.

The whole process from starting the application to getting the money paid into their accounts was without any problems. A lender that most clients recommend to people that are looking for a loan fast and without any hassles.

Capfin, a registered NCR lender is one of the most popular lenders in South Africa. And, with loans up to R50 000 and repayment options of 24 months, it makes it possible for everyone to afford to get a loan. Especially if you have an emergency and need the cash immediately.