Palmcredit is owned by Newedge Finance Limited and offers low-interest loans to borrowers above 18 years old in Nigeria through a palmcredit login online or via the mobile app. The loans are accessible in 3 minutes, allowing borrowers to use it to solve emergencies and settle urgent debts.

Palmcredit’s owner is licensed by the Central Bank of Nigeria. This means that their operations are legal, safe, and regulated. Hence, they tailor the best loan options to suit your needs.

You have seen the requirements for a Palmcredit loan. The process of registering on Palmcredit and completing a login should take 10 minutes. You will see the step-by-step process for registering and completing the login on the Palmcredit app or website. Here are the steps you need to register on the Palmcredit loan app:

Palmcredit is a reliable loan app that works on the Android app and the website. Once you complete the registration, you can access all of Palmcredit’s services at no extra cost. The only fees that apply are the transaction fees for non-users of the Palmcredit app.

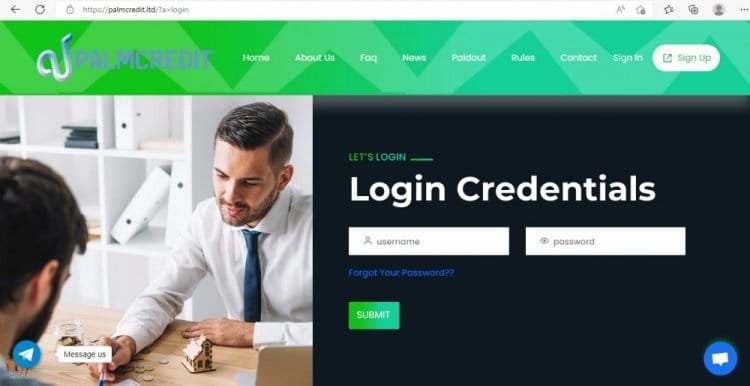

You will use your registration details when you want to login into Palmcredit. To complete the login process, use the following steps:

This will help you login successfully to the Palmcredit app. After completing the login, you can access loans. Follow these steps to access loans on Palmcredit:

This process should take 10 to 20 minutes. Immediately after your loan is approved, your bank account will be funded with a loan.

Palmcredit offers loans between ₦1,000 and ₦100,000 with an interest rate of 4.6%. The interest is void if you can repay your loan within two days. You can choose the deadline for repayment as long as it is within 14 to 180 days.

Another benefit will be that there is no limit to the amount that can be borrowed, even for new customers. However, to repay the Palmcredit personal loan, you will need a palmcredit account number for security reasons and to avoid paying to the wrong account.

The requirements for a Palmcredit loan are similar to other fintech roles. This is because to the norms and regulations that other loan lenders must go by, which are controlled by the Central Bank of Nigeria. Here are some requirements for a Palmcredit loan:

These are the requirements for the Palmcredt loan. Ensure you meet them before you login to Palmcredit.

Palmcredit has positive reviews on its mobile app and website. This could be due to their low-interest rates of 4.5% to 28%, the fast disbursement process, and a flexible repayment option for users. Palmcredit is worth a try if you want an instant loan application online.

Customer care also actively replies to queries, helping customers have issues with loan repayment. Palmcredit works and operates under the regulations of the Central Bank of Nigeria and the Lagos state Money Lending laws in Nigeria. This makes them a safe and reliable loan lender providing loans to solve your problems.