OPay allows you to easily perform fast and secure transactions with users of the app and non-users of the app. For example, pay your bills, collect loans, buy airtime or data, and do much more with the OPay app.

But to get access to features, you must create an account with OPay and log in. So how can you create an OPay account?

You can download the OPay App from your phone’s app store or access OPay on the web. You will see how to do both. To create an account with the OPay mobile app on Android, follow these steps:

To install the app on an iOS device, follow these steps:

Ensure you provide all the correct required credentials for the account creation. There is a limit for new customers when you create a new account. New customers are limited to N30,000 and a daily transfer limit of N10,000.

To remove the limitations, provide the following: Your BVN, government-issued ID, and utility bill. To create an account on OPay account on the web, here are the steps to follow:

The details you use to register are the same you will use to login. Right now, you can login to OPay with your Email address and phone number.

If you want to complete your login process with ease, read on. You will use your Email address, Phone number and set a password while registering.

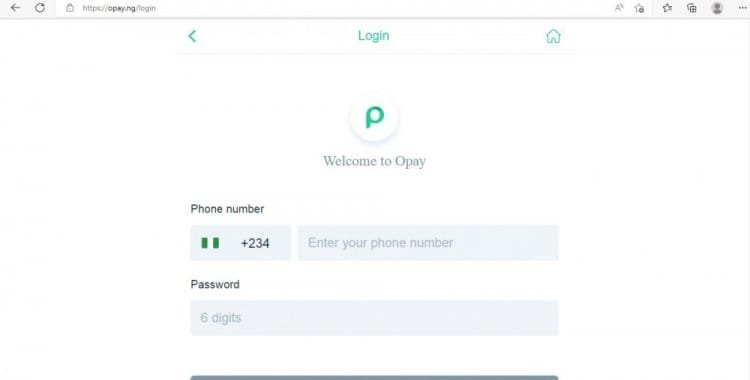

But some who have Opay accounts are now deprived of enjoying the important services offered by Opay as they face challenges trying to login to their respective Opay accounts. Use the steps below to login into your OPay account with your email address, phone number, and password:

If these steps are followed and the correct details are used, you should have no issue completing the OPay login. However, if you still have problems completing the login to your OPay account successfully, check for the following:

If you have checked and have any of these issues, you can easily resolve them by using the correct details and checking your network connection. If OPay is down, contact customer care for immediate solutions.

You can quickly login to your OPay account and access loans for emergencies, pay bills, transfer funds to other users or non-users of the app, and buy airtime or data.

Reviews about OPay Loan

There are many positive reviews for OPay loans, with users saying the loan disbursement is fast. You can quickly access loans from the OPay website login or the app without tight restrictions.

The best part is the longer repayment periods, but this also comes with a significant interest rate of 36.5%. OPay is part of a Nortwigish country but operates under the Nigerian money lending rules and regulations, which makes them safe for your loan options.