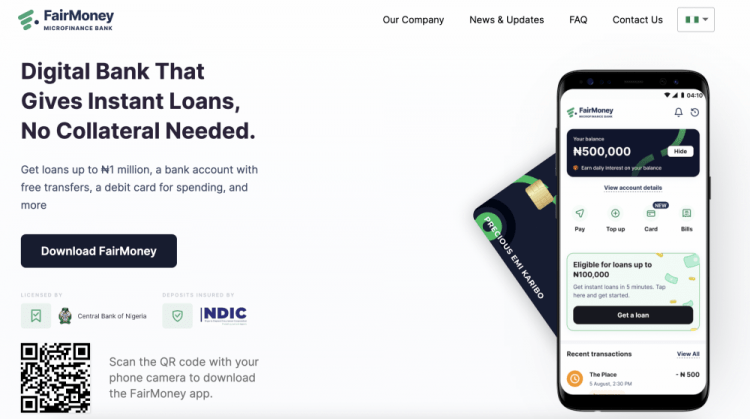

Loan apps offer access to quick loans making it possible to solve problems and foot bills as fast as possible. Fairmoney has a loan app and website you need to login to access the loan. They work to keep the website and mobile application running for borrowers making use of their platform to ensure that they get the best experience while looking for loans.

To get a Fairmoney loan, you will need access to the app. It is on the application that you will be able to login. Here are steps for how to get the mobile application and a loan from Fairmoney:

The phone number you use should match the one on your BVN. Else, login to FairMoney using Facebook. Completing the Fairmoney login allows you to obtain loans from the application.

The app is continually being upgraded to make it simple and reliable for Nigerians to access loans. The users of the app appreciate that Fairmoney does not stick to the strict process of applying for loans. The Fairmoney loan app is also accessible on the App Store for iOS gadgets.

The Fairmoney app can be downloaded on an iOS device. Even though there are differences between downloading an iPhone app and a mobile app, the process is very similar, so that's of downloading the app on an Android phone. Here are the steps for downloading the fair money app on iPhone and logging in:

The Fairmoney loan app is compatible with Android and iOS devices, but the web software cannot be accessed on a PC.

All you have to do when you get the Fairmoney loan app is to activate the app and create an account with your personal information. Ensure all the information provided is accurate because it will be needed for your Fairmoney login.

If you create an account using your Facebook information, it would be better because you will no longer be required to provide any additional information and you can simply use your Facebook profile to login next time.

The Fairmoney loan app automatically uses your Facebook information to create an account. Completing a Fair Money login is an easy process if you follow the steps mentioned above.

There are great aspects of a Fairmoney loan. Nigerians can access short-term and long-term loans with a simple login to an online account. It is a quick loan app that is reliable when you urgently need cash to solve a problem, pay bills, or transfer, making sure that anybody can use this loan.

The loans you can apply for start from ₦1500 and go up to ₦500000 with a long-term loan ranging from 60 to 180 days and monthly interest between 10% to 30%, and there are no additional fees or charges and collateral when it comes to obtaining a loan.

The interest varies depending on the amount collected and if you are a new borrower. For starters, if your credit score is bad, you will likely get a higher interest rate Fairmoney loan when you login to your online account, but if your credit score is good, you have a higher chance of getting a low-interest fairmoney loan.

After obtaining the loan from this Nigeria quick loan app, you will repay the loan at the agreed date. It is not possible to change the deadline for repayment as Fairmoney has no extension feature.

Fairmoney loans have similar requirements to other quick online loans in Nigeria. This is because most money lenders work by the rules and regulations of the money lenders law in Nigeria. Documentation does not seem to be Fairmoney's favorite thing. They, therefore, don't ask for much of you. The criteria for applying for loans are:

There are many reviews on the FairMoney loan platform. Most of them are positive reviews, while other negative reviews say the interest rate is high. FairMoney has been operating as a long-standing and trustworthy loan lender.

The reviews say the approval process is quick, and the loan is paid into your account within minutes. FairMoney loans are available to students, employed individuals, and business owners.

The best part is that they do not require collateral and pay the money into your account within 2 minutes and collect up to ₦1,000,000 if you pay your loans on time; otherwise, your loans could reduce drastically, or you will be blacklisted.

Fairmoney follows the rules and regulations of the Nigerian loan lending law and carries out its activities in a way built to suit your needs, giving you every alternative to pay the loan.